Shanu Mathew

Where capital markets meet climate transition

A passion for the environment turned into practical strategy and expertise. Currently an SVP and Portfolio Manager at a $250B+ global asset manager focused on Sustainable Investing.

Portfolio Manager & Research Analyst

Professional experience includes working at a global asset manager with ~$250+ billion AUM focused on Sustainable Investing. Prior to joining his current role in 2021, Shanu was a Vice President and Head of ESG at First Eagle Alternative Credit, a $20 billion+ alternative asset manager.

Previous experiences include Strategic Finance at Expanse (acquired by PANW for ~$1 billion) and Tech/Healthcare M&A banking at Evercore (~$40 billion of transaction experience).

Signature Topics

AI & Power Infrastructure

How the AI compute buildout is reshaping electricity demand and grid investment.

Climate Finance & ESG

Translating climate science into actionable investment frameworks and risk analysis.

Data Centers & Energy Transition

The intersection of hyperscale computing, renewable energy procurement, and grid modernization.

Net Zero & Carbon Markets

Navigating voluntary and compliance carbon markets, offset integrity, and decarbonization pathways.

Public Markets & Sustainability

Integrating sustainability factors into equity and credit analysis for long-term alpha generation.

Podcasts & Media

Dancing While the Music Plays: Clean Energy Equities Market

Energy Gang's 2025

AI and Power with Shanu Mathew

Who benefits from the AI power bottleneck?

From Wall Street to Clean Energy: Investing in the AI-Powered Power Grid

What sustainable investing looks like in practice

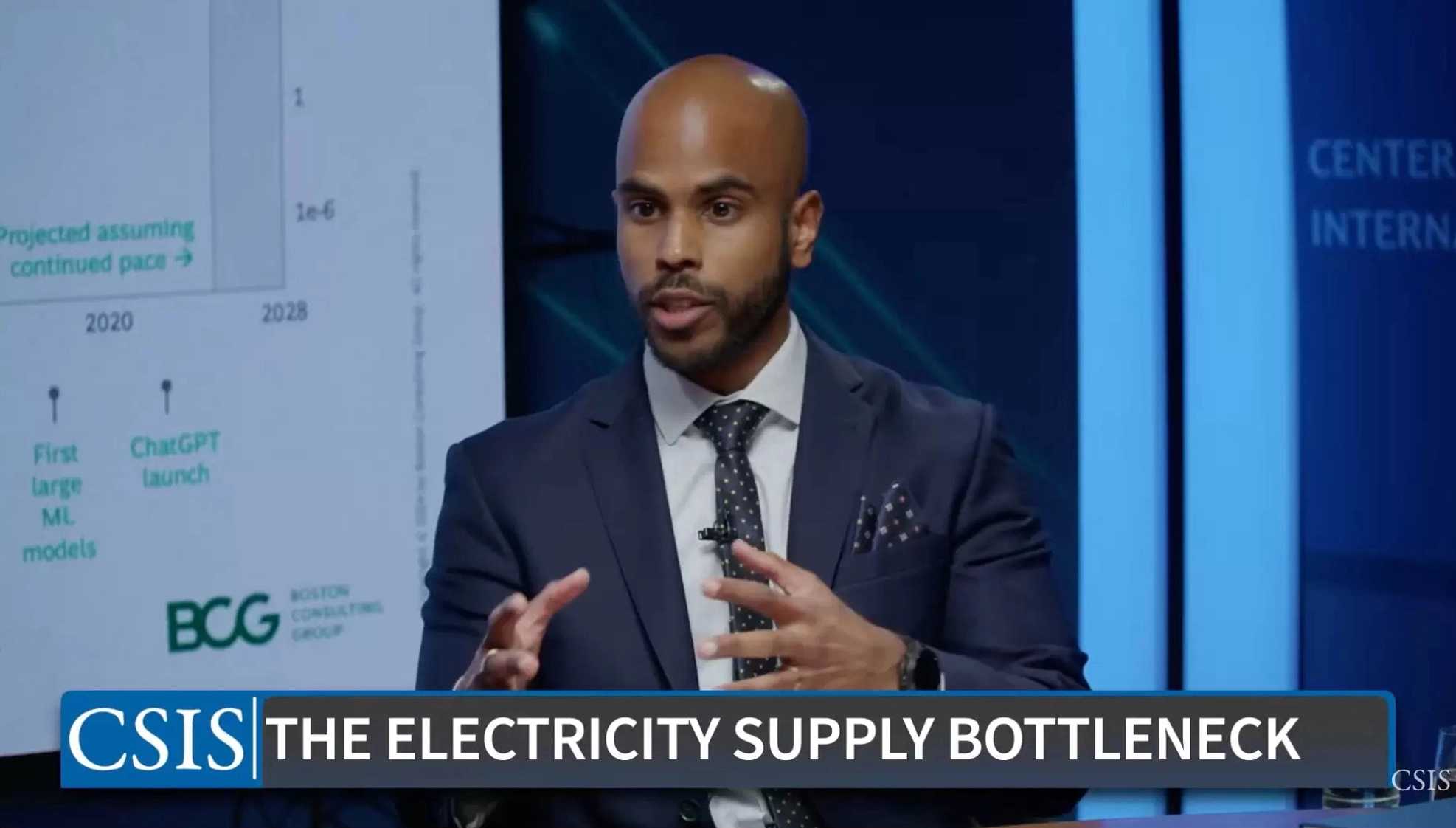

Recent Speaking

Hannam & Partners Data Center Investment Webinar

Hosted 200 power & energy investors, execs, and management teams last week for a discussion on data center infrastructure and power markets. The big takeaway: the demand debate is over — signed DC leases hit 16.4 GW in 2025 vs 3.3 GW the year before. The conversation has moved to "who can actually deliver."

Rothschild/Redburn Energy & Power Conference

Investor Perspectives on Nuclear: Covered nuclear energy's potential role in meeting long-term compute infrastructure power requirements and decarbonization objectives

AI Infra Summit: AI Data Center Electricity vs. Sustainability & SMRs

Examined the timeline challenges of developing sustainable energy solutions for AI data centers, focusing on SMR deployment schedules versus the immediate power needs of rapidly expanding AI infrastructure.

Latest Posts

Personal Year in Review Template

A structured framework for reflecting on your year and planning the next one. Every December, I spend a few hours doing an annual review.

Read Article →Recognition

IR Magazine Feature Article

IR Magazine featured the June 2024 panel about changing ESG expectations, the evolution of ESG, and more on their website! The 'teenage years' of ESG: Experts discuss shifting perceptions at ESG Integration Forum – Summer

Selected as a Crain's Chicago Business Notable Leader in Sustainability

Recognized as one of 52 honorees on Crain's Chicago Business Notable Leaders in Sustainability 2024. The award recognizes work in organizations of all sizes, from multibillion-dollar multinationals to local nonprofits, in sectors involving construction and deconstruction; agriculture and composting; energy, landscaping, finance and more.

Sightline Climate 2026 Predictions Special

Weighed in for the 2026 Predictions Special from Sightline Climate as an expert on climate & energy for the 2026 prediction bets.

Climate Tech Oracle 2024 Predictions Quiz Special

Stay informed

Curated insights on climate finance, markets, and the energy transition. Delivered to your inbox once a month.

Read The Balance